Insurance For Unlimited Solutions

Investment For You

Intwala For you

-

Insurance

Insurance -

Investment & GST

Investment & GST -

KeshavIITA

KeshavIITA

Welcome to KESHAV'S Insurance Investment Tax Addvisor

Insurance is not a luxury, it is a necessity then Why wait? Buy adequate insurance today!!

Starting early enables to build a big corpus with small savings.

Adequate regular income is must after retirement to maintain a healthy lifestyle.

You can ENSURE that come-what-may your child’s future is financially well secured.

Liaison’s with local, state and central bodies and their Tax liability.

We Bring The Best Things

-

LIFE INSURANCE

-

General Insurance

-

Investments

-

GST & TAX

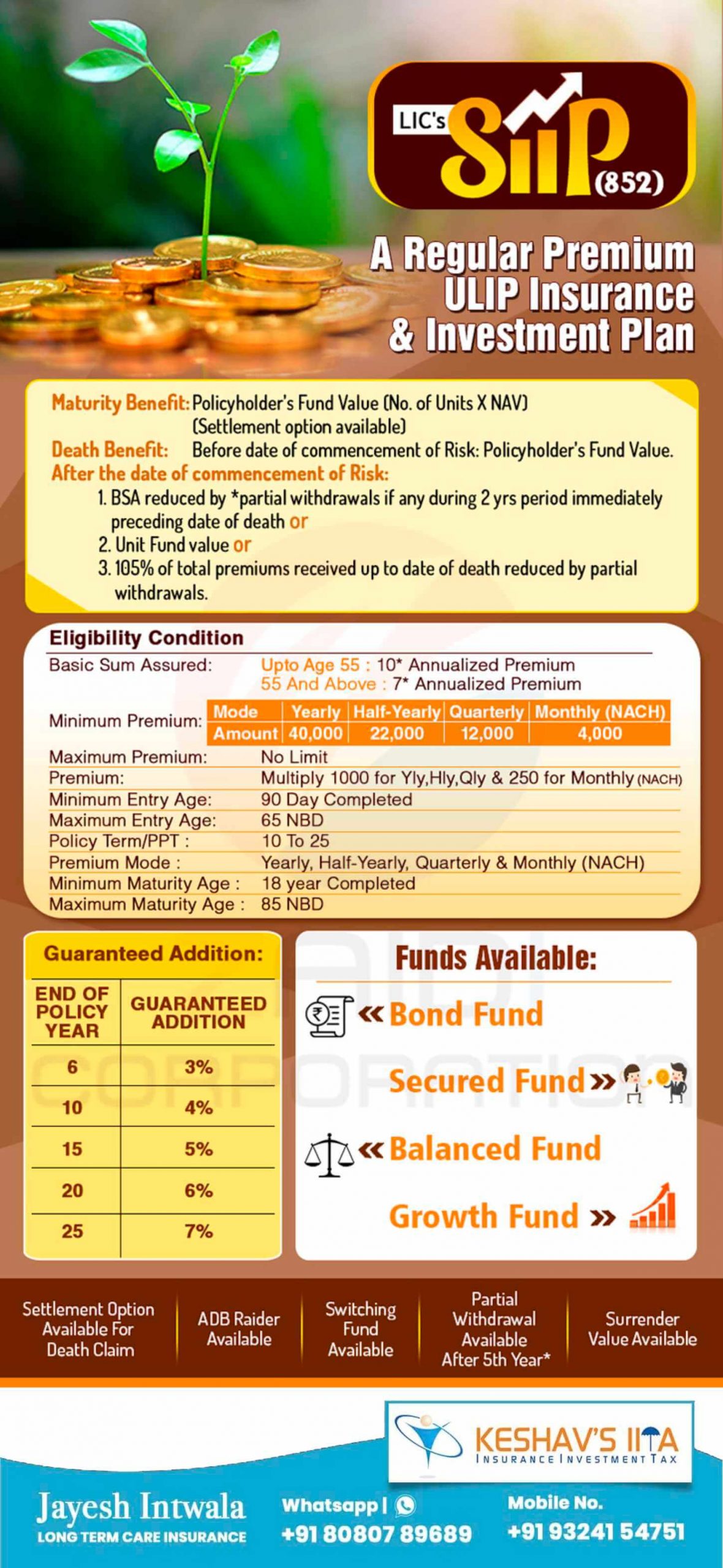

Life Insurance

We face a lot of risks in our daily lives. Some of these lead to financial losses. Insurance is a way of protecting against these financial losses. For a payment (premium), an insurance company will take the responsibility of compensating your financial losses.

Among other things, the contract also provides for the payment of premium periodically to the Corporation by the policyholder. Life insurance is universally acknowledged to be an institution, which eliminates ‘risk’, substituting certainty for uncertainty and comes to the timely aid of the family in the unfortunate event of death of the breadwinner.

Read MoreGeneral Insurance

Non-life insurance companies have products that cover property against Fire and allied perils, flood, storm and inundation, earthquake and so on. There are products that cover property against burglary, theft etc. The non-life companies also offer policies covering machinery against breakdown,there are policies that cover the hull of ships and so on. A Marine Cargo policy covers goods in transit, including by sea, air and road. Further, insurance of motor vehicles against damages and theft forms a major chunk of non-life insurance business. Suitable general Insurance covers are necessary for every family.

Most general insurance covers are annual contracts. However, there are few products that are long-term.

Read MoreInvestments

An asset or item that is purchased with the hope that it will generate income or appreciate in the future. In an economic sense, an investment is the purchase of goods that are not consumed today but are used in the future to create wealth. In finance, an investment is a monetary asset purchased with the idea that the asset will provide income in the future or appreciate and be sold at a higher price.

Investment is a conscious act of an individual or any entity that involves deployment of money (cash) in securities or assets issued by any financial institution with a view to obtain the target returns over a specified period of time.

GST & TAX

A fee charged by a government on a product, income, or activity. If tax is levied directly on personal or corporate income, then it is a direct tax. If tax is levied on the price of a good or service, then it is called an indirect tax. The purpose of taxation is to finance government expenditure. One of the most important uses of taxes is to finance public goods and services, such as street lighting and street cleaning. Since public goods and services do not allow a non-payer to be excluded, or allow exclusion by a consumer, there cannot be a market in the good or service, and so they need to be provided by the government or a quasi-government agency, which tend to finance themselves largely through taxes.

Read MoreMeet Our Team

KESHAV’S Insurance Investment Tax Addvisor is formed by Mr. Jayesh K. Intwala (B.Com, DCP, TCP, AMFI, CFP) & Mrs. Shila Jayesh Intwala (B. Art) in 2007, with the motive to give solution under one roof related to

- 1. Life Insurance (Term Insurance, Endovement Plans, Money Back Plan, Single Premium Plans, Pension Palns, Children Plans, Group Plans)

- 2. General Insurance (Health Insurance, House Hold Insurance, Office Umbrella, Fire Policey, Burglery Policey, Jewelers Policey, Marine Policey, Contractor All Risk Policey,Tailor Made Policey, Group Insurance)

- 3. Investment (Public Provodent Fund, National Pension Scheme, Monthly Income Scheme, National Saving Certificate, Mutual Funds, Government Bonds, Company Funds etc.)

- 4. Tax (Pan Card, Personal Income Tax, Firm & Co Registration, Professional Tax, Sales Tax, Service Tax, T D S, Account Writing Of Individual, Firm, Comapny, Trust, Co Op Society Up To Finalisation With Audit)

with the slogan INTWALA FOR UNLIMITED SOLUTIONS (i4u)…